As international crude oil continues to hold steady above $100, the Biden administration continues to weigh on oil prices by further implementing its promised 1.8 trillion barrel plan to release oil reserves.

The U.S. Department of Energy announced on Tuesday, May 24 local time that it will tender up to 40.1 million barrels of crude oil from the Strategic Petroleum Reserve (SPR), including 39 million barrels of sulfur-containing crude to be delivered from July 1 to August 15 and 1.1 million barrels of light, low-sulfur crude to be supplied from June 21 to 30.

The Energy Department said the new batch of bids and sales are part of the White House’s March announcement to release oil reserves. As other components of the operation, the DOE will also release a total of 90 million barrels of oil through two separate batches of 70 million barrels and 20 million barrels from May through August.

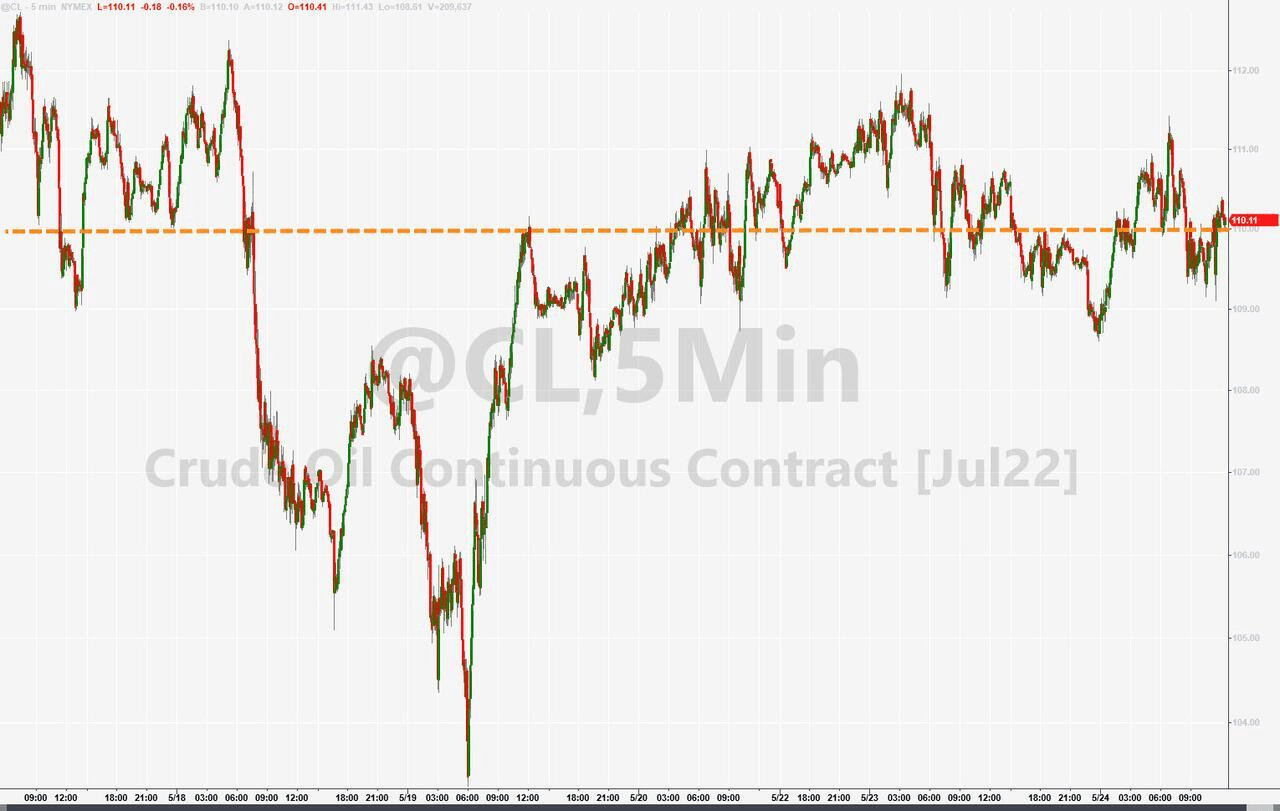

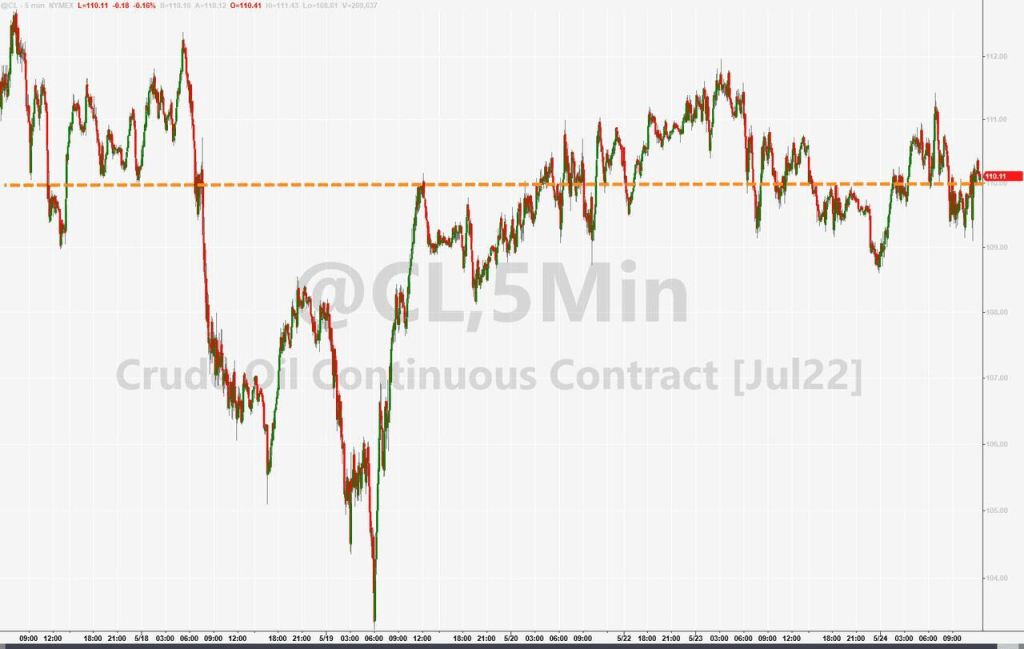

On the day the Energy Department announced its plan, international crude oil had turned lower during the day on Tuesday. European stocks before the new daily low, the U.S. WTI crude oil had fallen below $ 109, Brent crude oil fell below $ 112, down more than 1.5% during the day, European stocks turned up during the day, U.S. stocks at the beginning of the day when the new daily high, U.S. oil rose above $ 111.40, up about 1% during the day, the cloth oil rose above $ 114.60, up more than 1% during the day, but U.S. stocks turned down in early trading. Cloth oil has since rebounded, closing up 0.12%, U.S. oil failed to reverse the decline, closing down 0.47%, the last four trading days for the first time to close lower.

Crude oil had plunged after several recent outbreaks of massive oil reserve releases. In contrast, oil prices performed quite moderately this Tuesday.

On March 31 this year, the Biden administration announced that the U.S. would release 1 million barrels of strategic oil reserves per day for the next six months, releasing a total of 180 million barrels of oil, the largest release since the U.S. established its oil reserve program in 1974. WTI closed down about 7% that day, the largest closing decline since March 9, and Brent crude oil futures closed down 4.88%, and U.S. oil both hit a two-week closing low. the week of March 31, WTI fell 12.8%, and Brent oil fell 11.1%, both the largest single-week percentage decline since late April 2020. U.S. oil fell more than $14 for the week, the largest single-week dollar drop since 2011.

On April 6, media said that in an effort to curb the sharp rise in oil prices following the outbreak of the Russia-Ukraine situation, members of the International Energy Agency (IEA), a U.S. ally, were planning to release nearly 60 million more barrels of oil from their reserves. Crude oil plunged intraday that day, with WTI crude falling below $100 and having fallen nearly 6% intraday, and eventually and Brent crude both closing down more than 5%.

The following day, April 7, the IEA did announce plans to release a total of 120 million additional barrels of oil reserves, of which the United States released 60.56 million barrels, included in the total release of 180 million barrels announced in March this year, the remaining nearly 60 million barrels shared by the IEA member countries, the largest release record for non-U.S. IEA members.

As mentioned in a Wall Street Insight article since then, after the IEA announced that it was going to release a combined 120 million barrels, some institutions pointed out that the upward momentum of oil prices may be suppressed, such as Bank of America, which lowered the maximum expected price of Brent crude oil this summer from $150 to $120 per barrel, arguing that the emergency release of crude oil stocks in the next few years will have an impact on oil prices. However, some analysts point out that the essence of the strategic stockpile is only the transfer of the nature of the stockpile, not to change the overall global supply and demand of crude oil, in the long run, the release of oil reserves is not strong “sustainability”, will not help to alleviate the “structural shortage” of oil.